For US alcohol exporters – whether crafting bourbon, brewing craft beer, or bottling fine wines – selling to international markets is a significant opportunity for growth. Two US federal income tax regimes, the foreign-derived intangible income (FDII) deduction and the interest charge-domestic international sales corporation (IC-DISC), offer valuable ways to reduce tax liability and boost profits. Each has unique benefits and trade-offs, making them suited to different business needs. This blog post compares FDII and IC-DISC, helping alcohol exporters decide which tool – or combination – best fits their global ambitions.

Note that all discussions of tax rates are limited to US federal income tax. Additional state and local taxes and excise taxes may also apply.

FDII for Export Income

Introduced under the 2017 Tax Cuts and Jobs Act (TCJA), FDII incentivizes US C corporations to earn income from foreign sales while keeping operations stateside by providing a reduced effective tax rate on eligible export income derived from US-based corporations. It targets “intangible” income – profits exceeding a routine return on tangible assets – and applies a deduction directly on the exporter’s tax return.

How FDII Works

- Eligible income comes from selling alcohol (e.g., whiskey or wine) to foreign buyers for use outside the United States.

- The FDII deduction is 37.5% of qualifying income (dropping to 21.875% after 2025), reducing the effective corporate tax rate from 21% to 13.125% on that portion of income.

- No separate entity is required. Claims are made on the existing C corporation’s Form 1120.

Example: A winery exporting $2 million in Pinot noir with $400,000 in net profit might qualify $300,000 as FDII. A 37.5% deduction ($112,500) lowers the tax from $63,000 to $39,375, saving $23,625.

IC-DISC: A Classic Deferral and Rate Reduction Tool

The IC-DISC, a legacy export incentive from the 1970s, operates as a separate “paper corporation” that earns commissions on export sales. It is available to any US business structure (e.g., C corporations, S corporations, and LLCs) and shifts income to shareholders at a lower tax rate or defers it entirely.

How IC-DISC Works

- The exporter forms an IC-DISC and pays the entity a commission (up to 4% of export gross receipts or 50% of net export income).

- The commission is deductible for the operating company, reducing its taxable income.

- The IC-DISC pays no federal tax; instead, its income is distributed to shareholders as qualified dividends (taxed at 20% capital gains rate) or retained for deferral.

Example: A distillery owned by a closely held pass-through entity with $2 million in export sales and $400,000 in net profit pays a $200,000 commission to its IC-DISC. The operating company saves $74,000 in income tax (37%), while shareholders pay $47,600 in capital gains tax (20% plus 3.8% net investment income tax) on the dividend, netting a $27,600 savings.

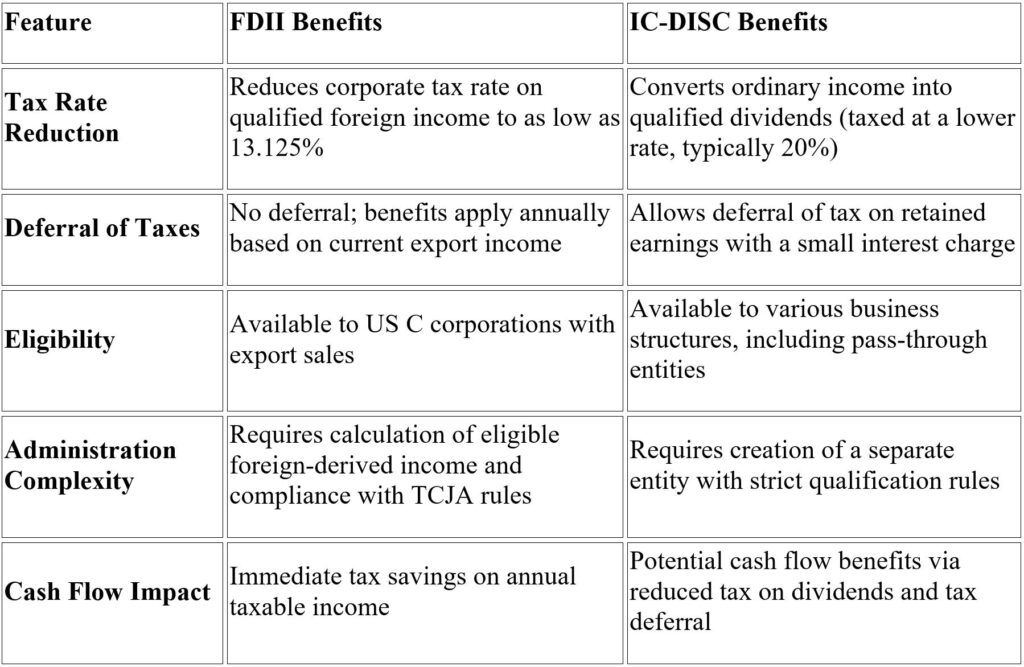

Comparing Tax Benefits: FDII vs. IC-DISC

Continue Reading

Continue Reading

read more

Subscribe

Subscribe